The ABC inventory control system is an approach based on the categorization of items or products depending upon their usage rate. It uses Pareto principles in its application.

It is applicable to those organizations that have multiple types of inventories. However, it is not always a good idea to keep the same level of controls for all type of inventories because there is a difference in terms of its value and annual consumption. Therefore the ABC inventory control system is applied to determine the value of each item with respect to annual consumption rate into categories A, B, and C.

ABC inventory control system focuses on major items in inventory, therefore, it is also termed as ”control by importance and exception”. Moreover, the categorization of the inventory items is done on the basis of the comparative value of different items, therefore this approach is also known as” proportional value analysis.”

Implementing ABC inventory controls

These factors should be considered while devising and implementing policies for effective ABC inventory controls.

- The reliability and accessibility of cost and demand information by item.

- Facilitation of Inventory management systems and processes in an efficient and effective implementation and operation of the ABC approach.

- costs and benefits of implementing and operating ABC inventory controls.

- Impact of change to the ABC approach on capability been assessed and planned for.

Categorizations in ABC inventory control

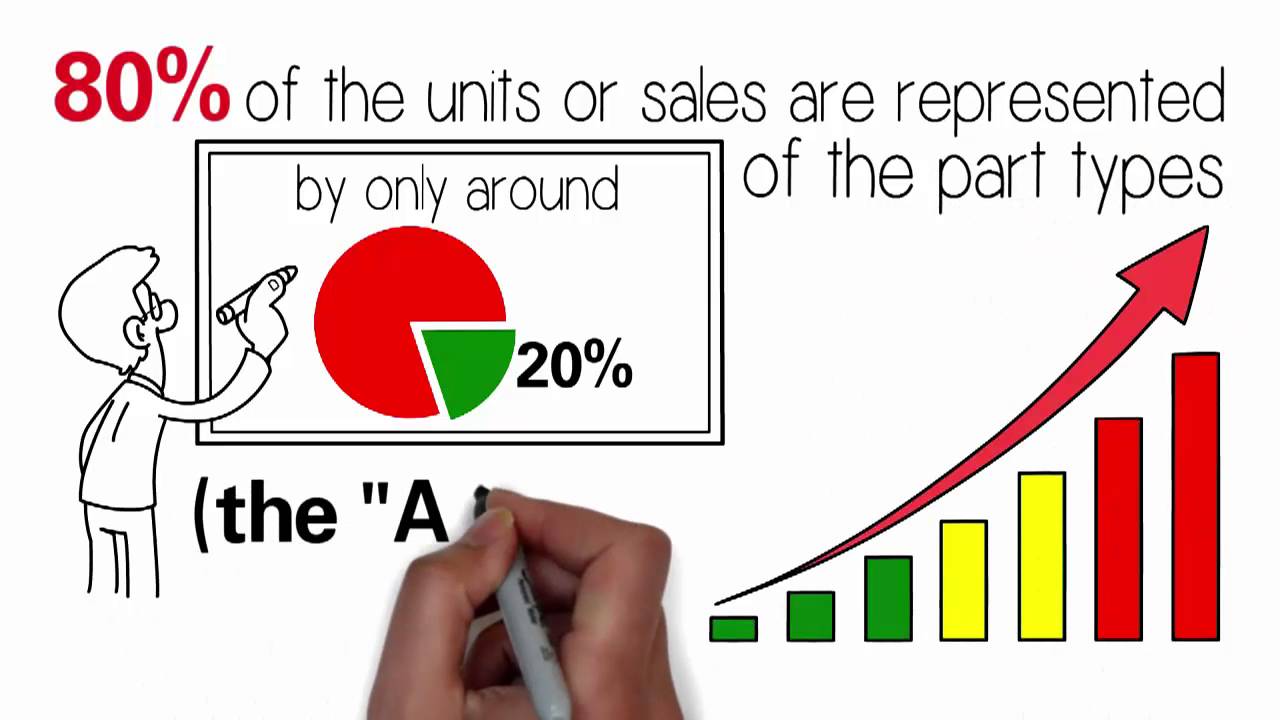

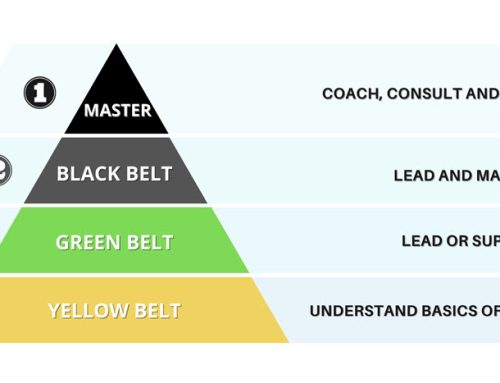

Category A items are goods which have the highest yearly consumption rate. Application of the Pareto principle which may be referred as the ‘’80/20 principle’’, where 80 % of the output is determined by 20 % of the input. They consist of a comparatively small number of items or goods, but have a fairly high consumption rate. So it is true that analysis and control of this category are comparatively intense as there is the utmost potential to decrease expenses or losses.

Category B items or goods can be considered as intermediate category items. Their consumption rate is less than category A items, but higher than the category C items. The main reason for having this interclass category is to look at items that are close to A items and C items, that will modify their inventory management policies if they move closer to category A or category C. Inventory management is itself considered as a cost, therefore it requires a balance between controls to protect the asset category and the value at risk of loss, or the cost of analysis and the potential value returned by reducing category costs. So, the scope of this category and the policies of inventory management are devised on the basis of estimated cost-benefit of category cost reduction, and loss control systems and processes.

Category C items or goods have the least consumption rate. This category has a comparatively greater proportion of the total number of lines but with comparatively small consumption rates. In fact, it is not typically cost-effective to set up tight inventory controls, as the risk of a major loss is comparatively small and the cost analysis will normally yield comparatively smaller returns.

As all the businesses are not the same, the thresholds that determine the higher and smaller limits of each category are not definable. Nor would they inevitably be fixed over time or across all geographical locations. An organization might have different risk appetites between different geographical locations. For example, a business in a high-crime region might have a greater proportion of items or, where a facility is less secure; more goods or items may be categorized as A. The accounts management should carry out risk and inventory management cost-benefit analyses location to deliver the optimal overall cost-benefit balance and to set the ABC ranges.

Benefits of Implementation

- Superior control of high-value inventory enhances availability and reduces expenses and losses.

- It provides a more effective use of stock management resources that saves time and money.

- A comparatively small value of B or C category items can let a business to hold greater buffer stocks to decrease stock outs. Lesser stock outs result in enhanced production efficiency.

Lesser stock outs and enhanced production efficiency also results in more consistent cycle time and, resulting in, better customer satisfaction.